Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

cfa-level-iii

08 Nov 2023

Private clients typically refer to individuals and families looking to invest their wealth. In contrast, institutional clients encompass companies or organizations that pool funds to achieve specific goals on behalf of owners and potentially other stakeholders.

This section aims to highlight the key distinctions in wealth management between individual and institutional clients, categorized as follows:

- Investment Objectives: Private clients often have diverse investment objectives, while institutional investors tend to have more clearly defined purposes.

- Constraints: These are common among individual clients due to shorter time horizons, smaller portfolio sizes, and higher tax burdens.

- Other: Institutional investors typically have formal governance structures and higher sophistication due to their substantial resources. Private clients' behavior often leans toward bias, while institutions usually exhibit more specific and well-defined strategies.

Investment Objectives

Institutional clients usually have straightforward investment objectives, often centered around meeting future liability streams, such as pension funds or banks.

Private clients' objectives revolve around dynamic issues like retirement planning. Determining how much to save today for an ideal retirement isn't a static question. Market conditions and lifestyle changes can influence the answer. Additionally, private clients may contend with competing goals, such as funding their children's education alongside retirement planning.

Constraints

Time Horizon

Institutional investors typically operate with much longer time horizons. For instance, unlike individual investors who have shorter timeframes, endowments often have an almost infinite investment horizon. While retirement might seem distant, it's relatively short compared to an endless horizon.

Scale

Institutional investors manage significantly larger portfolios than private clients. This gives them access to asset classes like private equity and real estate, which can be out of reach for individuals.

Taxes

Private clients are often more concerned about tax efficiency, especially if they're not tax-exempt like many institutions. Institutions may have professional accountants to assist with taxes, leading to different tax strategies.

Other

Investment Governance

Institutional investors usually have a formal governance structure in place. This might include a board of directors, an investment committee, and independent directors with investment expertise. They play a pivotal role in setting investment strategy and monitoring performance. In contrast, individual investors work with private wealth managers who define investment policies typically outlined in an investment policy statement.

Investment Sophistication

Institutional investors benefit from a structured governance system and often have access to wealth management professionals. However, they may also be susceptible to cognitive and emotional biases. Individual investors vary widely in attitudes, backgrounds, goals, and wealth sources.

Regulation

In some countries, both types of clients fall under the same regulatory body, while others, like the US, have different regulators based on investor type.

Uniqueness and Complexity

Individual investors are a diverse group with varying characteristics and needs. Institutional investors tend to have more uniform objectives, primarily focused on meeting future cash flow needs and liabilities.

Question

Compared to institutional clients, private clients are often associated with more (and/or stronger):

- Behavioral biases.

- Regulation.

- Investment sophistication.

Solution

The correct answer is A.

Regarding differences, behavioral biases are frequently more pronounced in individual investors. These biases can often be mitigated through the oversight of a Board of Governors and other financial professionals employed by institutions. Some biases, such as groupthink, are more relevant to investment committees and, thus, institutional investors. Nevertheless, these biases are less common than the numerous biases observed among private clients.

B is incorrect. While regulations and the regulatory authorities that enforce them may vary between institutional and private clients, both typically encounter some level of regulation.

C is incorrect. Institutional clients often possess substantial resources, allowing them to maintain a team of investment experts. This makes institutions generally more sophisticated investors compared to private clients.

Reading 7: Overview of Private Wealth Management

Los 7 (a) Contrast private client and institutional client investment concerns

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

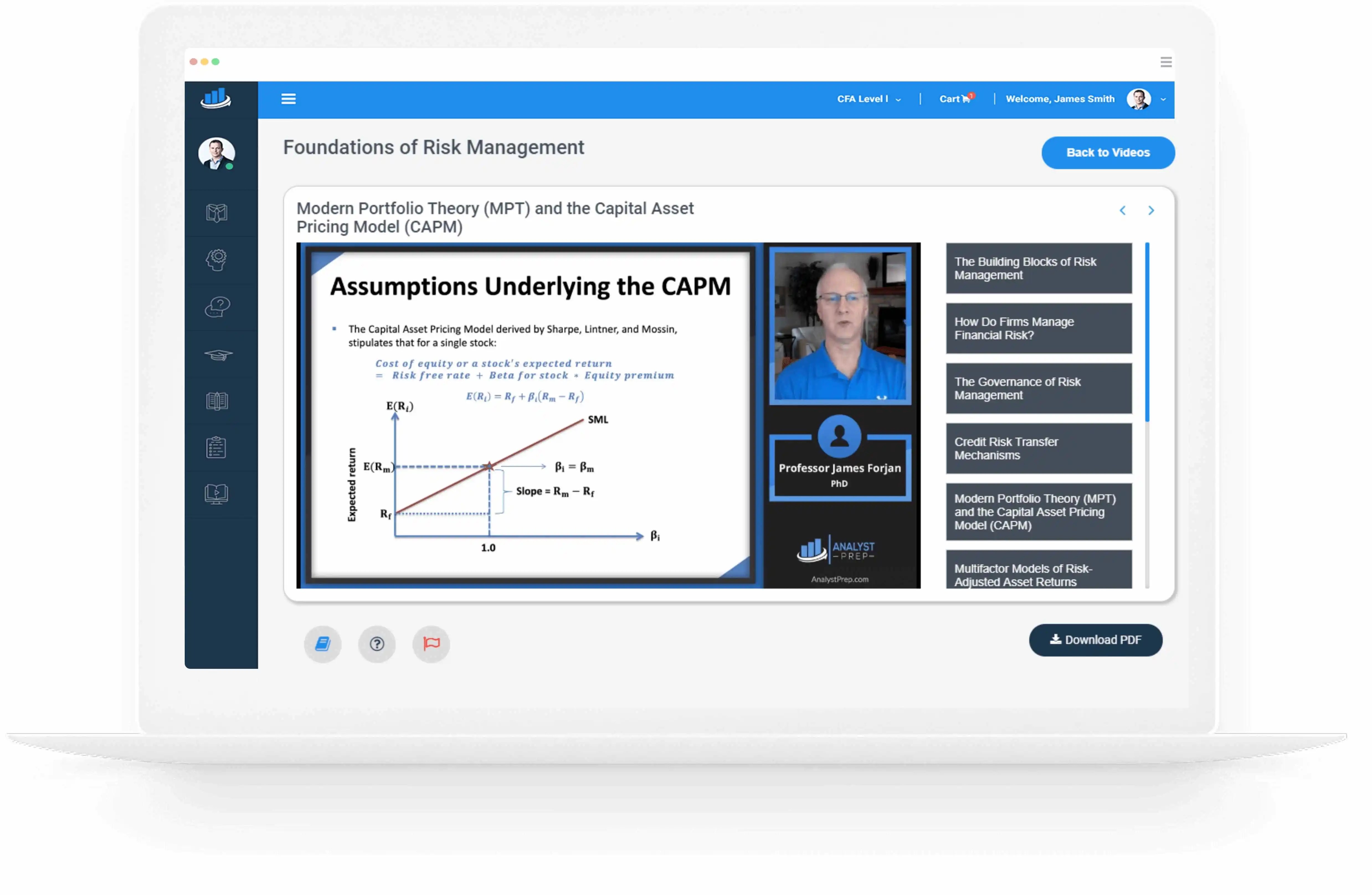

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts